This article is part of the Under the Lens series

Discrimination in the Marketing & Maintenance of REO Properties

This is the first entry in a series based on the National Fair Housing Alliance report, “The Banks Are Back, Our Neighborhoods Are Not,” that examines ongoing discrimination in the marketing and maintenance of bank-owned foreclosed properties.

This post, and the entire series, is also posted on Race-Talk, a blog hosted by the Kirwan Institute for the Study of Race and Ethnicity.

—

Is there a house in your neighborhood that everybody hates to walk past? You know, the one with broken and boarded up windows, trash left to gather on the lawn, and grass so overgrown it’s becoming a habitat for rodents?

If you have a house like that in your community, you know it’s more than just an eyesore. Neglected, vacant houses depress property values throughout the community, and can threaten health and safety. They erode the sense of community and stability that creates vibrant localities, and they hamper economic resiliency. With a national foreclosure crisis still in full swing, such houses are all too common.

You might be surprised to learn, though, that if you have problem properties like that in your neighborhood, there’s a good chance your absentee neighbor is a bank. More shocking still, banks are neglecting houses they own in minority communities even more frequently—much more frequently—than those they hold in white communities.

A detailed, undercover investigation unveiled last week by the National Fair Housing Alliance and several regional partners shows not only that banks too frequently fail to maintain foreclosed properties that they own, but that they tend to neglect their properties in communities of color at a much higher rate, with devastating consequences.

A large number of the neglected, bank-owned properties have broken or missing doors and windows, inviting vandalism and trespassers. And many have safety hazards that endanger the public. Those and other defects are significantly more prevalent in bank-owned properties located in communities of color.

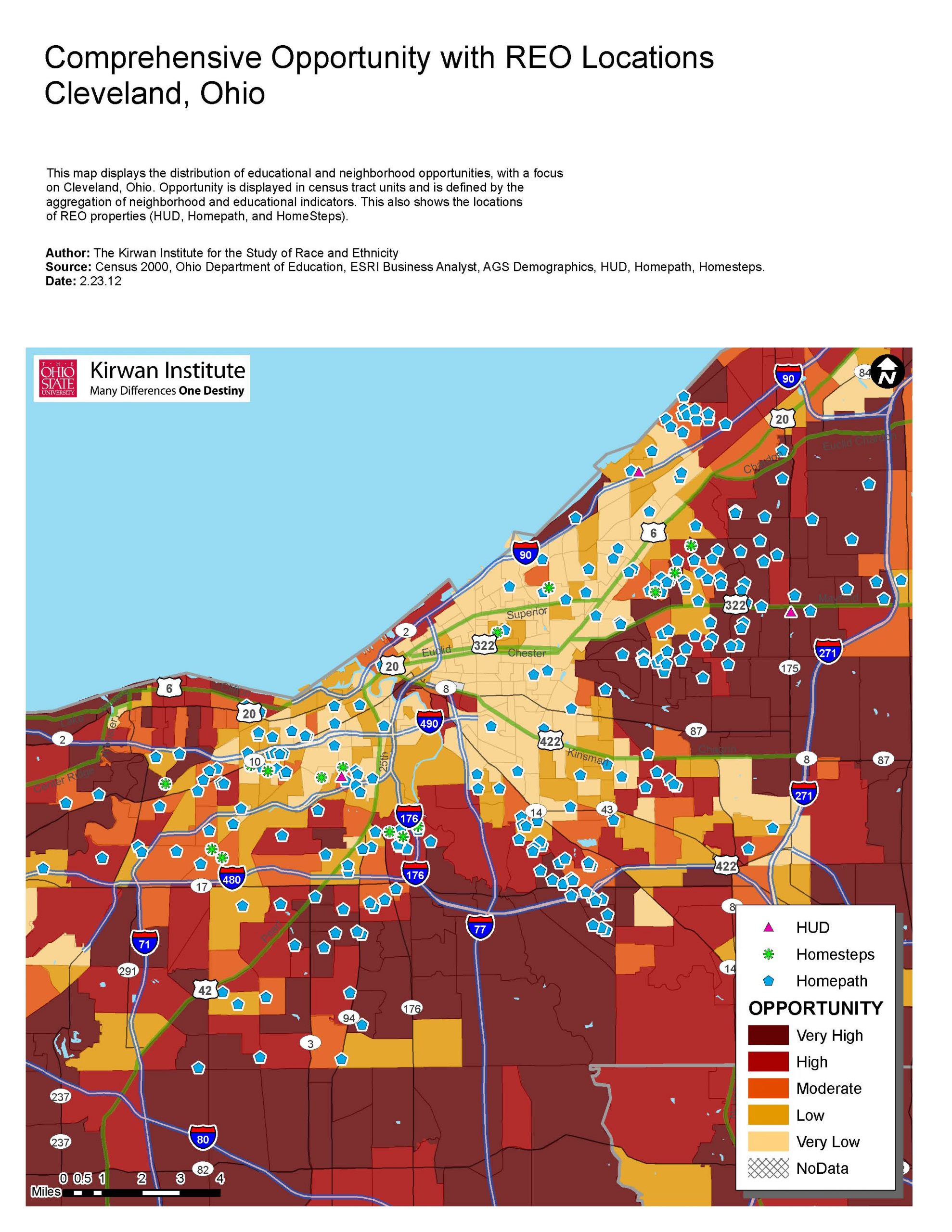

Another finding is that, on average, the banks are not marketing houses located in communities of color as aggressively to individual homebuyers as they do properties in white neighborhoods. The properties in white neighborhoods are, for example, more likely to have clear and professional “for sale” signs. When banks both poorly maintain and poorly market foreclosed houses, the properties tend to stay vacant longer and to eventually be sold to speculators, rather than to people who would make the houses their home.

The discriminatory differences are stark. In Dayton, Ohio, for example, 60 percent of bank-owned properties in African-American neighborhoods had broken or unsecured doors, compared to only 18 percent in white neighborhoods. In Atlanta, properties in African-American neighborhoods were almost five times more likely than homes in white neighborhoods to lack a “for sale” sign. And in Dallas, 73 percent of the bank-owned homes in predominantly non-white neighborhoods had trash on their properties, while only 37 percent in white areas did.

Neighbors of all races who live near foreclosed, bank-owned properties, the investigation found, are pulling together to keep them presentable—doing maintenance the banks should be doing, like mowing lawns and removing trash. But in communities of color, neighbors reported seeing home improvement contractors working on those properties at only half the rate seen by neighbors in predominantly white areas.

The bank behavior identified by this investigation is unethical, unlawful, and harmful to our economy. It breaches our basic national values of equal opportunity and the common good. It violates the Fair Housing Act of 1968, signed 44 years ago this week in the wake of Dr. Martin Luther King Jr.’s assassination. And it is holding back our economic recovery by, among other things, depressing home prices and hampering sales.

It’s hard to know all the reasons why banks are discriminating in this way. Bias and unfounded stereotypes about minority communities and homes, however, are a likely root cause. The investigators controlled for 39 race-neutral factors like building structure, water damage, and curb appeal, so the different treatment is indisputably about race, and not class or other home or neighborhood characteristics.

This investigation should be a wake up call for banks, regulators, local governments, and the neighbors of these bank-owned properties. Among the solutions identified by the National Fair Housing Alliance are anti-discrimination investigations by the Consumer Financial Protection Bureau and other enforcement agencies, making information about bank-owned properties more publicly accessible, and prioritizing buyers who will occupy these properties over speculators who may warehouse them.

As Americans struggle together toward a lasting economic recovery, good neighbors are more important than ever. It’s time to remind America’s banks that this includes them.

—

This series is a collaborative effort under the Compact for Home Opportunity/Home4Good campaign and builds on the disparities illiustrated in the National Fair Housing Alliance report, “The Banks Are Back, Our Neighborhoods Are Not.” Those disparities are used as an entry point to discussing the issues of REO properties and equal opportunity that surround it.

Blog series contributors include Alan Jenkins of the Opportunity Agenda; Jillian Olinger of the Kirwan Institute for the Study of Race and Ethnicity at the Ohio State University; Debby Goldberg of the National Fair Housing Alliance; Miriam Axel-Lute of the National Housing Institute; Liz Ryan Murray of National People's Action; and Janis Bowdler of the National Council of La Raza.

Comments