In a Shelterforce–hosted roundtable discussion of leading research and policy experts to looking at what makes housing affordable and how the nationwide housing crisis changed the affordable housing landscape, NHI senior fellow Alan Mallach expressed some alarm when it came to the replenishment, or lack thereof, two to four-unit unsubsidized properites. Their ability to provide a big source of affordable rental housing, he said, should not be understated:

“I think the erosion of the two to fours is particularly severe because they’re simply not being replenished. In the single family rentals, you have a kind of an ongoing churning going back and forth with respect to a lot of units, which may be in rental occupancy for a certain period, then ownership, then rental, and so forth, so I suspect that part of the stock probably replenishes itself somewhat better than the two to fours, which are—[along with] the small multi-families, five, six, eight, ten units—not being replaced. They’re very hard to make work financially in terms of new construction. Municipalities tend not to encourage them in terms of land use regulation zoning codes, and they’re incredibly hard to finance if you’re a builder or a developer.”

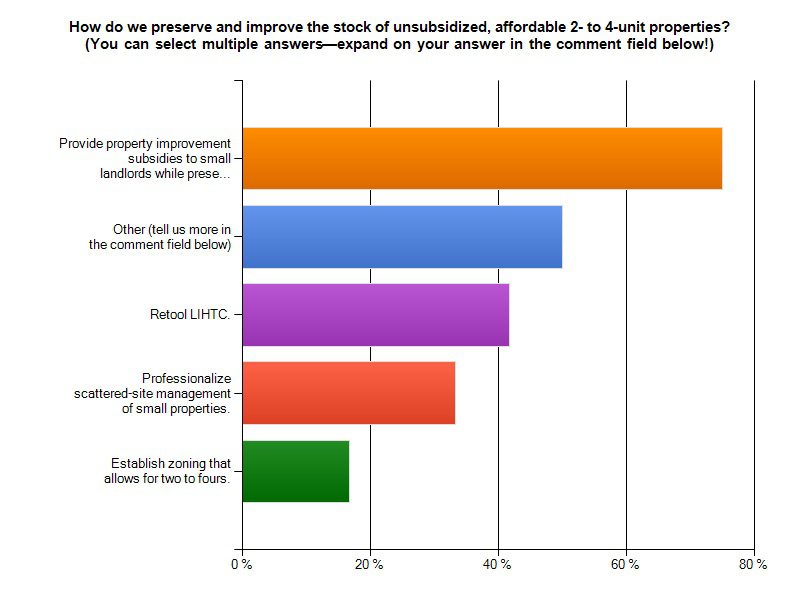

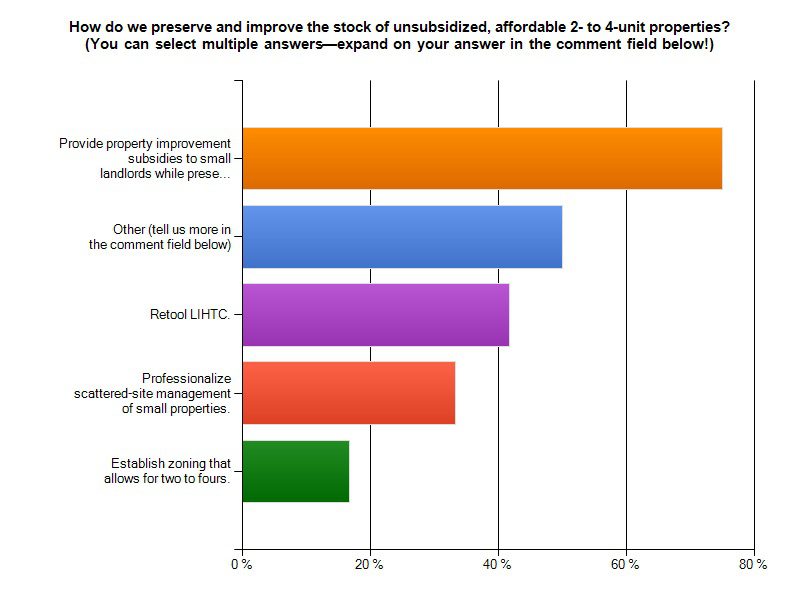

So we put the question to you: “How do we preserve and improve the stock of unsubsidized, affordable 2- to 4-unit properties?“

While all responses were insightful, there was particular interest from Chicago-area readers, providing us with an opportunity to spotlight a specific area.

You said:

Finding financing for investors, whether they are small neigborhood investors, or larger investors, is very important. Unfortunately, financing for these investors can be difficult, since 1- to 4-unit financing is geared toward—and built for—owner occupants. While we would love to have owner occupants buy these buildings, in distressed neighborhoods, there just isn’t much demand – and if someone has the credit and wherewithal to purchase a 2-4 unit building to occupy, they have lots of other options. This is why we need to figure out financing for investors. The Preservation Compact in Chicago and Cook County, funded by the MacArthur Foundation and located at CIC (mentioned by Jeff Lubell in the interview), has done quite a bit of analysis on this issue. —Stacie, Chicago

“Subsidize the write-down of existing mortgages on these types of properties. The main reason rents escalate is to keep pace with costs. If a major portion of per unit cost was lowered (ie, the mortgage(s)), owners could be incentivised to lower rents. Of course, in exchange for this write down, an owner would have to commit to a period of affordability or face repayment.” —Esther, Chicago

“Change the national conversation about ‘affordable housing’ (and yes, particularly among non-profit developers and agencies) to include this kind of housing stock and the Ma & Pa owners who have these buildings. Also need changes in mortgage lending to make financing available for owners or buyers of these properties without subjecting them to the same standards as an LLC or partnership that is borrowing millions for a large-scale project or doing a tax credit deal. A significant percentage of affordable rental housing in Chicago is in this type of building, yet these owners are completely ignored by the lenders, municipal government, and the ‘affordable housing industry’ – both non-profit and for profit.” —Anon., Chicago

Comments