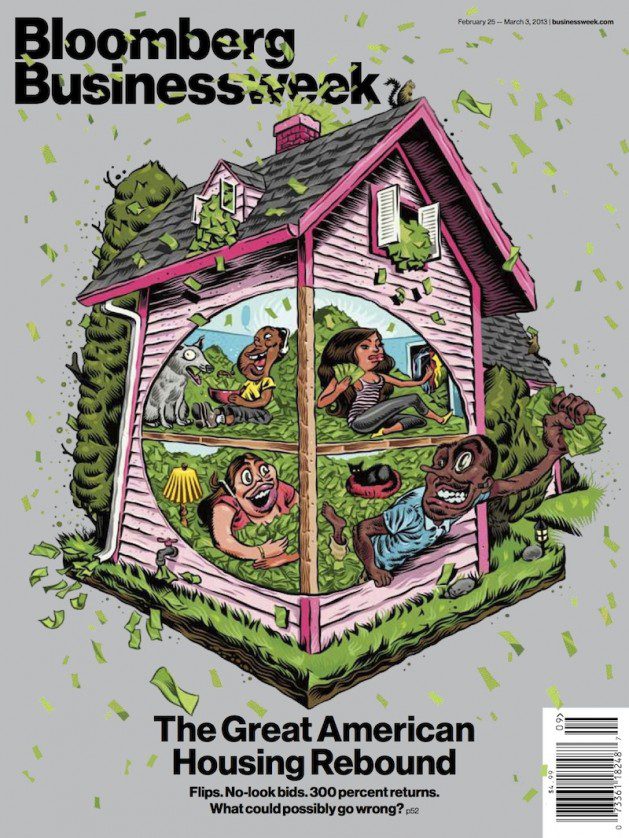

The following is, sadly, not a spoof, but a real cover illustration on an article about the housing market:

Now, we here at Rooflines were wondering too just the other day if a new bubble was forming.

But really, that question, and the article itself, have nothing to do with this cover, which has justifiably caused a firestorm for perpetuating, in fine racist fashion no less, some of the worst mistruths about what happened during the housing and foreclosure crisis, who benefited, and who, not to put too fine a point on it, got screwed.

As the Kirwan Institute said it its response to this cover:

The cover’s implication that American families got rich from subprime shenanigans is perverse. The only people who truly made the fistfuls of cash depicted on the cover were largely hedge fund managers. The most recent estimate of household wealth losses due to the old mortgage industry is seven trillion dollars. Yes, trillion, with a capital “T.”

This illustration says American families are greedy, selfish, isolated derelicts. Is this the story that we want to tell ourselves — about ourselves, our country, and our values? This is what we aspire to tell the world? That average American families are the laughable, stupid (“what could go wrong?”) drivers of billion-dollar financial institutions’ behavior?

In a press statement, National Fair Housing Alliance called the cover “offensive and flatly inaccurate,” continuing:

We were shocked and dismayed by a Jim Crow era cover and its depiction of homeowners of color. It is so mind-boggling and even difficult to know what this newsmagazine was trying to convey. A more accurate cover would have depicted Big Bank CEOs and Wall Street moguls who provided monetary incentives to push predatory loans.

It’s important to know that our nation’s foreclosure crisis is the result of reckless lending that targeted borrowers and communities of color for risky, unsustainable loans even when they qualified for prime mortgages. Skyrocketing foreclosure rates triggered by these toxic loans have lead to at least one trillion dollars in lost wealth for African-American and Latino communities.

The U.S. Department of Justice demonstrated this problem with its multi-million dollar fair lending cases against Wells Fargo and Countrywide Financial Corp. for steering thousands of African-American and Latino homeowners into high-fee and/or subprime mortgage products even though these families were as creditworthy as white borrowers.

Bloomberg Businessweek displays a shocking misunderstanding of what is happening to homeowners throughout our nation. The magazine’s editor-in-chief owes readers an explanation and a real apology. The use of caricatures to tell whatever story it hoped to convey is not only appalling, but seriously calls into question the magazine’s credibility as an effective forum for discussion of the housing crisis.

That sums it up pretty well. And it's not just about our sensitive sensibilities either. As people still suffer and we still have Too Big for Trial banks, these narratives have real implications for housing policy and fair enforcement of the law going forward.

What I found odd about the cover is, as the Washington Post asserted, the article itself is quite benign. After reading the article, I was struck by the feeling that Bloomberg must be leaking readership if they had to couch a decent article in an inflammatory and tabloid-like cover. Oh, and it also made me throw my renewal notice in the recycle bin.