L

Proponents of this system apparently believe the requirement that investors absorb the first 10 percent of losses will ensure that only high quality MBS be issued. Those who are old enough to remember that investment banks had no trouble selling subprime mortgage backed securities with no government guarantees might be more skeptical. It is not clear why anyone would believe that the quality of the MBS being issued under the Crapo-Johnson system would be any better than under in the housing bubble days of the last decade.

Provisions that might have helped to ensure the quality of these MBS were stripped away over the last four years. In the immediate wake of the crisis there was widespread sentiment that issuers should have to retain a substantial stake in the mortgages they put into pools. As the rules now stand issuers would have to retain no interest in mortgages that had as little as 3.5 percent down payments. This is in spite of the fact that these mortgages default at more than five times the rate of mortgages with 20 percent down.

The bond rating agencies are also largely unreformed. The Senate overwhelmingly passed the Franken Amendment which would have had the Securities and Exchange Commission select the rating agency for a new issue rather than the bank putting together the MBS. This removed the obvious conflict of interest in the ratings for hire system that led to so much AAA junk in the bubble years. But this provision was stripped out in conference and replaced with a requirement for the SEC to study the issue. After two and half years, the SEC ruled that picking bond rating agencies exceeded its competence.

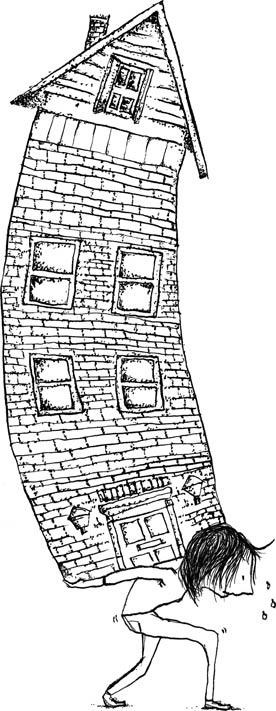

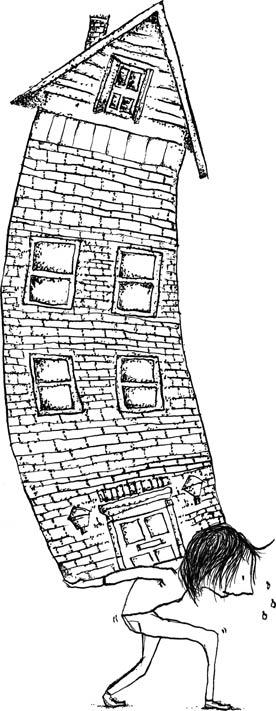

We have no real safeguards that should provide any reason to believe that banks will be better behaved than they were in the bubble years. And, we have a government guarantee to provide strong incentives to make them less well behaved.

So congratulate Senators Crapo and Johnson and all the people who worked designing this legislation. Many people thought it was impossible to have a worse morass of moral hazard and conflicts of interests than existing in the housing market in the bubble years. They have proven them wrong.

I agree with Dean, it is beyond ludicrous to incentivize the mortgage industry to create risky loans and securitize them with governmental guarantees. Does no one read history? It wasn’t just the 2008 meltdown. What about the 1920’s banking bubble before Glass-Steagall? Or 1987? 0r 2001? The Securities industry has a poor record of self-control. If there are ways to twist regulations and laws to make money, someone will find it and use it. Why make it easier at our expense?