“For most Americans, the housing crisis is hardly a thing of the past.”

This is how Hart Research Associates opened its presentation on the second annual “How Housing Matters” study for the MacArthur Foundation yesterday. The results are based on a national telephone survey done in April polling 1,355 adults.

The survey is meant to “develop a deeper understanding of the experiences, attitudes, and perceptions about housing” but to Rooflines readers, the results will be neither new nor surprising.

The findings confirmed those from last year's study, which showed that over half of Americans are making serious tradeoffs to afford a roof over their head.

The sacrifices include one ore more family members taking on a second job, putting off saving for retirement, accumulating credit card debt, making cuts in health care and healthy foods, and moving to a worse neighborhood with poor schools.

The findings also reveal that there is a lot of skepticism leftover from the Great Recession and many Americans no longer believe that owning a home is a solid path to building equity.

Although home ownership is still a dream for many, most Americans now see renting and ownership as equally attractive and believe the government should be doing more to increase the affordability for both sets.

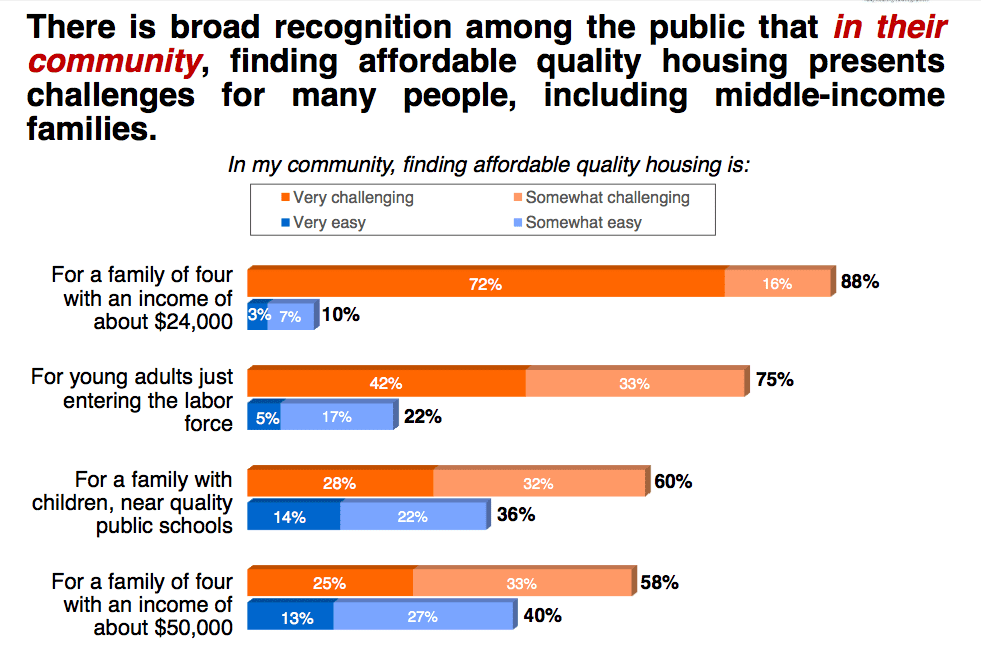

Many of the results were intuitive: distressed (those who pay more than 30 percent of their income on housing) homeowners and renters felt less stable in their housing situations; and distressed homeowners and renters felt it was more challenging to find affordable housing in their communities.

For housing activists this may not be enlightening, but the survey found that the majority of Americans also have an understanding of how challenging the housing market is for all types of people, which may say something about how premature reports of “recovery” are.

Seventy percent of people believed the housing crisis is not over and that the worst is yet to come—this was consistent among different demographics of race, age, and education.

While 85 percent of people ages 18 to 34 still aspire to own a home, 62 percent of people in the same age range think its less likely than 20 or 30 years ago to build equity or wealth through homeownership. Majorities of people said buying a home has become less appealing while renting a home has become more appealing and that renters can be just as successful in achieving the American Dream.

The presentation ended with more of a question then an outcome: Is the American Dream of homeownership dying or changing?

No matter the answer, the results showed that housing—where people live and the security they feel living there—is a central issue that should be addressed and supported by policy to improve affordability for renters and owners alike.

Homeownership

The American Dream Under Duress?

“For most Americans, the housing crisis is hardly a thing of the past.” This is how Hart Research Associates opened its presentation on the second annual “How Housing Matters” study […]

Comments