While today, media coverage of the Federal Reserve Board is fairly prevalent, in the 70s the Fed was more of a shadow force only tracked by wonks. Then came Paul Volcker with his cigar, and there was a new sheriff and new face of the Fed in town.

But before we jump back 35 years, let’s be clear: Inflation is BAD! Was then and would be again. But the Fed has always had a dual mandate: control inflation and strive for low unemployment. Often the Fed sheriff has clearly chosen one over the other.

In early 1980, Congress passed a law that gave Paul Volcker’s Fed control over almost all lenders in the United States, not just the commercial banks that were members of the Fed system. Volcker used that law to require non-interest bearing reserves resulting in rising mortgage interest rates. Guess who got hurt? Millions of Americans trying to own or improve their homes and communities throughout the country.

Volcker told Congress that the Home Mortgage Disclosure Act (HMDA) passed in 1975 should be gutted. Volcker’s Fed was refusing to enforce the Community Reinvestment Act (CRA), which was passed in 1977 but only had regulations promulgated in February 1979.

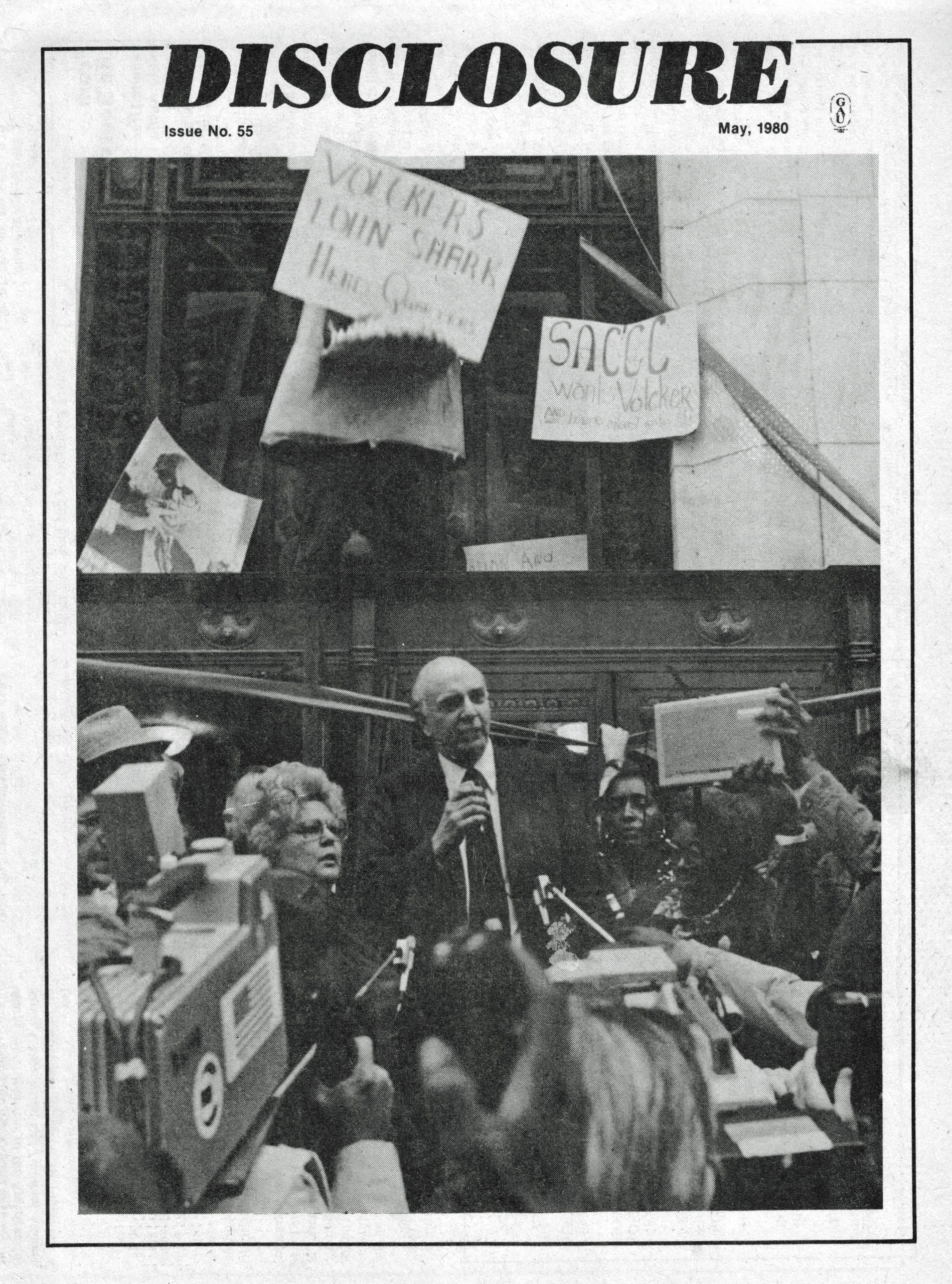

On March 14, 1980, President Carter invoked the Credit Control Act of 1969, giving Paul Volcker sweeping power over how financial institutions allocated credit. So a month later, 2,000 community leaders, who were in D.C. for the 9th annual conference of National Peoples Action came knocking on the Fed door.

Younger readers may need to Google “Chevy Chase Land Shark” to fully appreciate the Jaws theme music that goes along with the door knocking. One of the staff from the Northwest Bronx Community and Clergy Coalition had borrowed Chevy’s Land Shark head from NBC’s Saturday Night Live wardrobe for their D.C. visit. The shark head and the protest made the NBC Nightly News.

Fifteen community leaders were finally admitted for Volker’s first meeting with the American public. Volcker’s reprise throughout the meeting was, “I have no power. I’m only the chairman of the Federal Reserve.” Finally, when he said, “We only have the power to control the money supply,” a few people had to laugh. Even Volcker himself had to smile at what he had just said. Finally, he agreed to come outside and inform the crowd that they would subsequently meet again in May to discuss policy recommendations.

National Peoples Action didn’t just protest for the fun of it. They were calling for a Federal Reserve Neighborhood Credit Policy to lower interest rates for loans targeted to owner-occupied homes and multi-family properties providing affordable housing for low- and moderate-income families. Reserve requirements would be lowered for financial institutions making “reinvestment loans.” They would be allowed to borrow from the Fed at special low rates and longer terms provided that the full amount of these funds were used for “reinvestment loans.”

Stop to consider the business model flaw in recent predatory lending. Lenders decide that low- and moderate-income families are “risky,” so they charge a higher interest rate. That makes the mortgage more costly and less affordable.

Without the availability of affordable credit, community reinvestment cannot proceed. The CRA requires that lenders have a “continuing and affirmative obligation to make credit available.” But unless that credit is affordable, financial institutions will not be fostering community development.

Our economy may be improving, but our communities still need to be restored. Over six years ago, I posted on Rooflines: “So now besides no home, it’s no job. And this time, there is no place for Tom Joad to head to tonight.” There are too many Toms still looking.

It’s way past time to revisit a Federal Reserve Credit Policy that targets reinvesting in low- and moderate-income communities. Inflation may not be knocking on the door but income inequality is haunting our economy.

“Neighborhood people are mad that they are expected to bear the brunt of inflation while the rich are only inconvenienced by having to pay a bit more for dinner in a French restaurant when they jet over to Paris for a weekend jaunt.”—Gale Cincotta, “Next Move” Disclosure, Issue #55, May 1980

(Image credit: Courtesy of Ted Wysocki)

Comments