Experience has taught me that having a policy solution is only half the battle. The next step is making financial tools available in every economically distressed urban neighborhood and rural community in the country. We know what fair and responsible banking looks like. And we know it can transform people’s economic prospects and build stronger communities.

Ninety-three million Americans live in households that are unbanked or rely on check cashers, payday lenders and other high-cost financial outlets. For African Americans and Latinos, roughly half of all households fall into these categories. And with income and wealth gaps widening and the nation growing more diverse, the need for solutions grows more urgent every day.

The way I see it, we must tackle these challenges in multiple ways. First, CDFIs need to scale up. Massively. We must dramatically increase the capacity of CDFIs to serve people and places that traditional banks do not. This will require substantial investment by the public, private, and philanthropic sectors.

Second, mainstream banks must do more to support all segments of the population. Thanks in large part to public investments and supportive policies, bank profits have rebounded to record levels since the recession. At the same time banks are closing branches in, and otherwise failing to serve, many low-income, elderly, rural, and minority communities. Bank regulators should use a mix of incentives and accountability measures to ensure that banks reinvest in these people and places.

One way to do this is through partnerships between mainstream banks and CDFIs. We could call this the carrot approach. Banks get regulatory relief, CDFIs get the resources needed to scale up, and communities get access to the services of mission-driven financial institutions.

Another way is by enforcing fair lending practices. We must remind banks that discriminating against protected classes of people is against the law. (Protected groups include people distinguishable by race, color, national origin, gender, age, disability, and familial circumstances.)

Unfortunately, sometimes these reminders involve holding banks accountable through regulation and ultimately through the courts. We could call this the stick approach. Using a stick only works, however, if it is made of strong stuff.

This is why HOPE signed on to an amicus brief in the case, Texas Department of Housing and Community Affairs vs. The Inclusive Communities Project. This case, currently before the U.S. Supreme Court, could severely weaken enforcement of the anti-discrimination provisions of the Fair Housing Act. In the face of this threat, we decided to join the National Fair Housing Alliance and the Center for Community Self-Help to urge the court to uphold the use of the “disparate impact” standard in discrimination cases.

The issue currently before the Court is whether housing policies are illegal when they have a “disparate impact” on protected groups of people covered by the law. For example, if a lending institution adopted a policy to refuse mortgage loans for row houses and it resulted in a disproportionate number of denials to African American customers, the policy would be illegal.

We have 20 years of data and experience that shows that when people are treated fairly they can grab a rung on the ladder of opportunity and pull themselves up. In order to keep that ladder within reach, we must eliminate abusive, predatory practices with every tool we have. That includes the disparate impact doctrine.

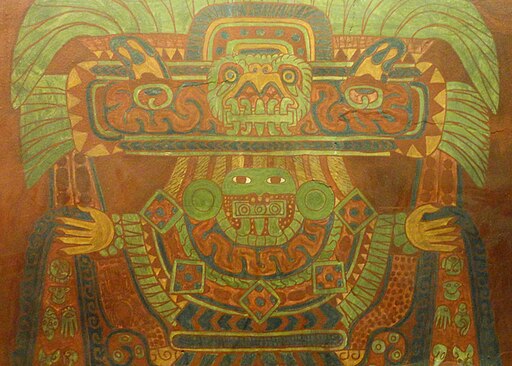

(Photo credit: HOPE Enterprise Corporation)

Comments